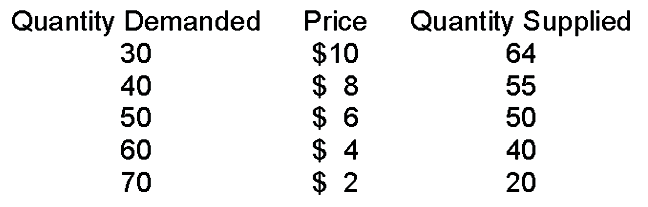

When price is $8

A. quantity demanded is greater than quantity supplied and, therefore, price must fall to get to equilibrium price.

B. quantity demanded is greater than quantity supplied and, therefore, price must rise to get to equilibrium price.

C. quantity supplied is greater than quantity demanded and, therefore, price must fall to get to equilibrium price.

D. quantity supplied is greater than quantity demanded and, therefore, price must rise to get to equilibrium price.

C. quantity supplied is greater than quantity demanded and, therefore, price must fall to get to equilibrium price.

You might also like to view...

FICA is a payroll tax imposed on employers and workers that is used to fund Social Security and Medicare. Which of the following statements regarding the tax is true?

A) Most economists believe the burden of the tax falls almost entirely on workers. B) Congress wanted the burden of the tax to be greater for employers than for workers. C) Most economists believe the burden of the tax falls mostly on employers. D) Employers are required to pay a greater share of the tax than workers but most economists believe the burden of the tax is shared equally.

A Starbucks Grande Latte costs $3.75 in the U.S. and 28 yuan in China. The nominal exchange rate is 6.75 yuan per dollar. The real exchange rate is

a. 1.106 . If purchasing-power parity held the nominal exchange rate would be higher. b. 1.106 . If purchasing-power parity held the nominal exchange rate would be lower. c. .904 . If purchasing power parity held the nominal exchange rate would be higher. d. .904 . If purchasing-power parity held the nominal exchange rate would be lower.

Which of the following is not correct?

a. Deficits give people the opportunity to consume at the expense of their children, but deficits do not require them to do so. b. Deficits and surpluses could be used to avoid fluctuations in the tax rate. c. The only times deficits have increased have been during times of war or economic downturns. d. Reducing the budget deficit rather than funding more education spending could, all things considered, make future generations worse off.

Which of the following is an example of a positive externality?

A. something obtainable at a zero price B. a discount for consumers buying in large quantity C. increased purchases of landscaping services by a homeowner that boost a neighbor's property value D. a lower crime rate for a community in which residents receive more education