company believes that the volume will go up to 12,000 units if the company reduces its sales price to $7.50. How would this change affect operating income?

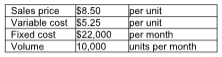

A small business produces a single product and reports the following data:

A) It will increase by $5500.

B) It will increase by $10,500.

C) It will decrease by $5500.

D) It will decrease by $10,500.

C) It will decrease by $5500.

Explanation: Contribution margin (before reduction in sales price) = $8.50 - $5.25 = $3.25

Operating income (before reduction in sales price) = (10,000 × $3.25) - $22,000 = $10,500

Contribution margin (after reduction in sales price) = $7.50 - $5.25 = $2.25

Operating income (after reduction in sales price) = (12,000 × $2.25) - $22,000 = $5000

Decrease in operating income due to reduction in selling price = $10,500 - $5000 = $5500

You might also like to view...

Since recruiting and maintaining a panel of willing respondents is expensive and time consuming, "panel equity," or the value represented by the panel will likely become more important in the future

Indicate whether the statement is true or false

In establishing the project’s baseline, the time-phased budget ______.

A. allows us to identify the correct sequencing of tasks B. enables the project team to determine the points in the project when actual costs are likely to exceed budgeted costs C. identifies the individual work packages and tasks necessary to complete the project D. provides the managerial responsibilities for tasks in a project

Which of the following is an example of a firm that is failing its fundamental social responsibility?

A. A firm that prioritizes environmental sustainability B. A firm that has its loss margins exceeding its profit margins C. A firm that uses resources at unsustainable rates D. A firm that is financially unstable

Data for an adjusting entry described as "accrued wages, $2,020" means to debit

A) Wages Expense and credit Wages Payable B) Wages Payable and credit Wages Expense C) Accounts Receivable and credit Wages Expense D) Drawing and credit Wages Payable