Trevor and Brian enter into a partnership and decide to share profits and losses as follows:

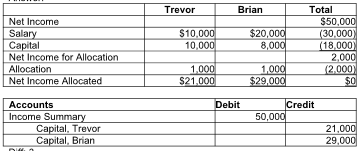

1. The first allocation is a salary allowance with Trevor receiving $10,000 and Brian receiving $20,000.

2. The second allocation is 20% of the partners' capital balances at year end. On December 31, 2019, the

capital balances for Trevor and Brian are $50,000 and $40,000, respectively.

3. Any remaining profit or loss is allocated equally.

For the year ending December 31, 2019, the partnership reported net income of $50,000.

Required:

1. Calculate the share of profit allocated to each partner.

2. Prepare the journal entry to record the allocation of profit on December 31, 2019.

You might also like to view...

ISO 9000 registration is required for regulated products sold in the United States

Indicate whether the statement is true or false

________ stands for AIDS Related Complex

Fill in the blanks with correct word

Suppose a firm has a growth rate equal to 8 percent, return on assets (ROA) of 10 percent, a debt ratio of 20 percent, and a current stock price of $36. The firm's return on equity (ROE) is:

A. 14.0%. B. 12.5%. C. 15.0%. D. 2.5%. E. 13.5%.

Operating Within the Environment (Scenario)The environment places constraints on the behavior of managers. Suppose you are the manager of a real estate office trying to maximize profits. You attempt to understand the forces within your organization's environment.If the mortgage interest rates increase, this would be an example of changing ________ in your external environment.

A. economic conditions B. political conditions C. sociocultural conditions D. demographic conditions