Empirical studies find that exchange rates are much more variable than inflation differentials. How can we explain this empirical result?

What will be an ideal response?

Financial markets adjust faster than goods market. Therefore, for any exogenous shock or news, we expect exchange rates to change faster than prices. Thus the differential speed of adjustment makes exchange rates much more variable.

You might also like to view...

Traditional Keynesians tend to favor

a. monetary policy over fiscal policy because of the effectiveness of central banks. b. monetary policy over fiscal policy because it reduces interest rates.. c. fiscal policy over monetary policy because it doesn't impact interest rates. d. fiscal policy over monetary policy because of the liquidity trap. e. none of the above.

Ongoing inflation has its own momentum because

a. prices rise whenever firms see other prices rising b. the public learns to expect inflation and adjusts its decisions in response c. public officials are unwilling to stop prosperity d. more and more people now have jobs e. we are always playing catch up, trying to get what we lost when others raise prices

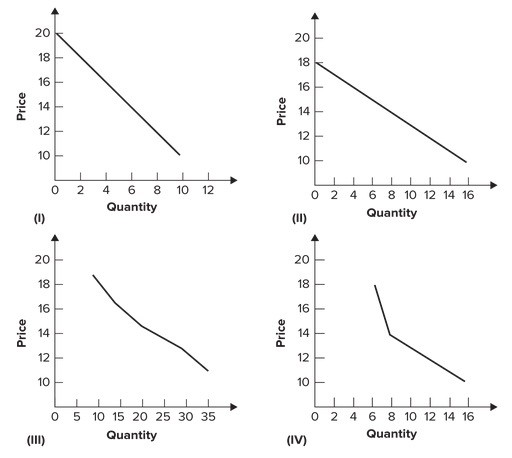

Refer to the following graphs: Which curve depicts the market demand from the following individual demand tables?PriceD1D2D310101510128119146781643718206

Which curve depicts the market demand from the following individual demand tables?PriceD1D2D310101510128119146781643718206

A. I B. II C. III D. IV

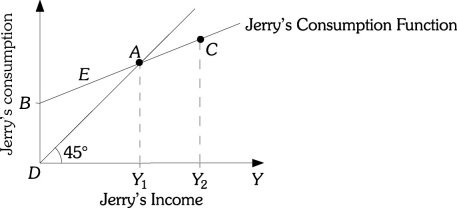

Refer to the information provided in Figure 23.2 below to answer the question(s) that follow. Figure 23.2Refer to Figure 23.2. The line segment BD represents Jerry's

Figure 23.2Refer to Figure 23.2. The line segment BD represents Jerry's

A. consumption when income equals Y1. B. consumption when income equals zero. C. saving when income is Y1. D. saving when income equals zero.