Subsidies for silver, the Bland-Allison Act of 1878, and the Silver Purchase Acts of 1890 and 1933 all provide examples of government programs

(a) based on careful analysis of benefits relative to costs.

(b) designed to redistribute income from the rich to the poor.

(c) that reflect the political attractiveness of special-interest issues.

(d) that promote the general welfare.

(c)

You might also like to view...

Extreme monetarists assert that changes in the money supply

A. Affect prices and the unemployment rate. B. Can affect only real GDP. C. Can affect only the price level. D. Affect prices and real GDP.

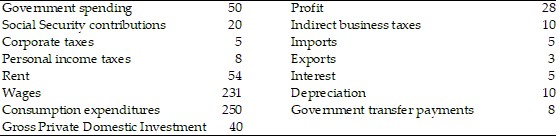

Using the above table, the Personal Income (PI) for the country is

Using the above table, the Personal Income (PI) for the country is

A. 84. B. 155. C. 306. D. 228.

Studies have shown that smoking cigarettes can cause heart disease. Assume this is true, and favorable weather has increased the tobacco harvest in North Carolina. In the market for cigarettes, these two developments would

A) decrease demand and decrease supply, resulting in an increase in the equilibrium quantity and a decrease in the equilibrium price of cigarettes. B) increase demand and increase supply resulting in an increase in the equilibrium quantity and an uncertain effect on the equilibrium price of cigarettes. C) decrease demand and increase supply, resulting in a decrease in the equilibrium price and an uncertain effect on the equilibrium quantity of cigarettes. D) decrease demand and increase supply, resulting in an increase in both the equilibrium price and the equilibrium quantity of cigarettes.

An increase in the growth rate of population in a steady-state economy would cause

A. a pivot up and to the left in the investment line. B. a pivot down and to the right in the investment line. C. a parallel shift downward in the investment line. D. a parallel shift upward in the investment line.