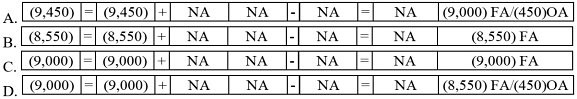

Use the following to answer questions 117-118:Baltimore Company issued a $9,000 face value discount note to Bank of the Chesapeake on March 1, Year 1. The note had a 5% discount rate and a one-year term to maturity.After accruing all interest expense due as of April 1, Year 1, Baltimore Company made the cash payment for the full amount due (i.e., principal and interest) to Bank of the Chesapeake. How does the cash payment affect the elements of Baltimore's financial statements??Assets=Liab.+Stk. EquityRev.-Exp.= Net Inc.Stmt. of Cash Flows

What will be an ideal response?

D

The maturity date of the note is April 1, Year 1. At maturity, since all interest has been accrued through that date, the discount account has been reduced to zero, so the carrying value of the liability is equal to the note's face value. At maturity, the face value of the note of $9,000 is repaid, which decreases assets (cash) and liabilities (notes payable). However, only the amount initially borrowed of $8,550 is reported as a cash outflow for financing activities; the amount of the discount that is paid of $450 is reported as an operating activity since it represents interest expense.

You might also like to view...

An example of an unmanageable question during negotiation is a

A. close-out question. B. directive question. C. cool question. D. window question.

Pro forma financial information is often used to illustrate the effects of various types of transactions. Pro forma financial information would be least likely to be used with which of the following transactions?

a. Setting up a bond sinking fund. b. Disposing of a significant segment of a business. c. Proposing the sale of securities and applying the proceeds to a project. d. Business combinations.

Under common law, the landlord had no obligation to mitigate the damages caused by the tenant's abandonment by attempting to rent the leased property to a new tenant.

Answer the following statement true (T) or false (F)

In a "basket" or "lump-sum" purchase of assets, which of the following best describes the process by which the historical cost of the various assets acquired should be determined?

a. Allocation of the total cost to the individual assets on the basis of the historical cost of the individual assets to their original owner. b. Allocation of the total cost to the individual assets on the basis of the fair market value of the individual assets at the time of the "basket" purchase. c. Recording of the individual assets at their current value with recognition of a gain or loss for the difference between the price paid for the assets and the current value of the individual assets. d. Recording of the individual assets at their original historical cost to the seller with a gain or loss recognized as the difference between the total of the original historical cost figures and the price paid in the basket purchase.