Using the expectations hypothesis on the term structure of interest rates, explain the relationship between the interest rate on a one-year Treasury bond and the interest rate on a two-year Treasury bond

What will be an ideal response?

The expectations hypothesis asserts that the relationship between the interest rate on the one-year bond and the interest rate on the two-year bond should be such that the average of the interest rate on a current one-year bond and the expected interest rate on a one-year bond one year from now should equal the interest rate on the two-year bond.

You might also like to view...

Growth accounting is seen a useful way to estimate this inputs contribution to growth:

A. technology. B. physical capital. C. labor. D. land.

The production decisions of perfectly competitive firms follow one of the Ten Principles of Economics, which states that rational people

a. consider sunk costs. b. equate prices to the average costs of production. c. prefer to purchase products from smaller rather than larger firms. d. think at the margin.

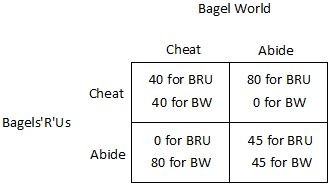

The market for bagels contains two firms: BagelWorld (BW) and Bagels'R'Us (BRU). The owners of the two firms decide to fix the price of bagels. The table below shows how each firm's profit (in dollars) depends on whether they abide by the agreement or cheat on the agreement.  For Bagels'R'Us, ________ is a ________.

For Bagels'R'Us, ________ is a ________.

A. abiding by the agreement; dominant strategy when Bagel World also abides B. abiding by the agreement; dominant strategy C. cheating on the agreement; dominant strategy D. cheating on the agreement; dominated strategy

Maximum Feasible Hourly Production Rates (in Tons) of EitherWine or Beef Using All Available ResourcesProductArgentinaFranceWine (gallons)3060Beef (pounds)1030Use the above table. Assuming constant opportunity costs, the opportunity cost of producing a gallon of wine in France is

A. 0.5 pound of beef. B. 0.33 pound of beef. C. 2 pounds of beef. D. 3 pounds of beef.