Which wholesaler channel function is demonstrated when a wholesaler's sales force helps a manufacturer reach many small customers at a low cost?

A) bulk breaking

B) selling and promoting

C) buying and assortment building

D) warehousing

E) risk bearing

B

You might also like to view...

A well-known car manufacturing company introduces a new hatchback model by describing its distinctive features and then stressing the speed and safety qualities of the car

Which of the following is the company using to convey its membership in the hatchback segment? A) announcing category benefits B) comparing to exemplars C) relying on the product descriptor D) using channel differentiation E) maximizing negatively correlated attributes

Answer the following statements true (T) or false (F)

1) A business maintains a separate Accounts Receivable account for each customer in order to account for payments received from the customer and amounts still owed by the customer. 2) Because customers make payments on account throughout the period, the sum of all balances in subsidiary accounts receivable will not equal the control account balance. 3) By accepting credit and debit cards, companies are able to attract more customers. 4) When businesses accept payment by credit and debit cards, there is almost always a fee to the purchaser to cover the processing costs charged by the card issuer. 5) Sales through credit or debit cards transfer the risk of collection of receivables from the seller to the card issuer.

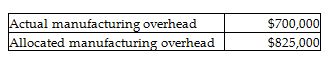

Davie, Inc. used estimated direct labor hours of 240,000 and estimated manufacturing overhead costs of $1,150,000 in establishing its predetermined overhead allocation rate for the year. Actual results showed the following:

What was the number of direct labor hours worked during the year? (Round any intermediate calculations to two decimal places, and your final answer to the nearest whole number.)

A) 146,087 hours

B) 282,857 hours

C) 240,084 hours

D) 172,234 hours

Present Value of 1Periods3%4%5%6%7%8%9%10%12%30.91510.88900.86380.83960.81630.79380.77220.75130.711840.88850.85480.82270.79210.76290.73500.70840.68300.635550.86260.82190.78350.74730.71300.68060.64990.62090.567460.83750.79030.74620.70500.66630.63020.59630.56450.506670.81310.75990.71070.66510.62270.58350.54700.51320.452380.78940.73070.67680.62740.58200.54030.50190.46650.403990.76640.70260.64460.59190.54390.50020.46040.42410.3606100.74410.67560.61390.55840.50830.46320.42240.38550.3220Future Value of

1Periods3%4%5%6%7%8%9%10%12%31.09271.12491.15761.19101.22501.25971.29501.33101.404941.12551.16991.21551.26251.31081.36051.41161.46411.573551.15931.21671.27631.33821.40261.46931.53861.61051.762361.19411.26531.34011.41851.50071.58691.67711.77161.973871.22991.31591.40711.50361.60581.71381.82801.94872.210781.26681.36861.47751.59381.71821.85091.99262.14362.476091.30481.42331.55131.68951.83851.99902.17192.35792.7731101.34391.48021.62891.79081.96722.15892.36742.59373.1058Present Value of an Annuity of 1Periods3%4%5%6%7%8%9%10%12%32.82862.77512.72322.67302.62432.57712.53132.48692.401843.71713.62993.54603.46513.38723.31213.23973.16993.037354.57974.45184.32954.21244.10023.99273.88973.79083.604865.41725.24215.07574.91734.76654.62294.48594.35534.111476.23036.00215.78645.58245.38935.20645.03304.86844.563887.01976.73276.46326.20985.97135.74665.53485.33494.967697.78617.43537.10786.80176.51526.24695.99525.79505.3282108.53028.11097.72177.36017.02366.71016.41776.14465.6502Future Value of an Annuity of 1Periods3%4%5%6%7%8%9%10%12%33.09093.12163.15253.18363.21493.24643.27813.31003.374444.18364.24654.31014.37464.43994.50614.57314.64104.779355.30915.41635.52565.63715.75075.86665.98476.10516.352866.46846.63306.80196.97537.15337.33597.52337.71568.115277.66257.89838.14208.39388.65408.92289.20049.487210.089088.89239.21429.54919.897510.259810.636611.028511.435912.2997910.159110.582811.026611.491311.978012.487613.021013.579514.77571011.463912.006112.577913.180813.816414.486615.192915.937417.5487Pelcher Company acquires a machine by issuing a note that requires semiannual payments of $4,000 for 3 years. The interest rate on the note is 10% compounded semiannually. What is the cost of the machine? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) A. $17,421.20 B. $20,302.80 C. $ 9.947.41 D. $10,892.80 E. $24,000.00