What three critical factors or preconditions turned a national, U.S. problem into a global financial crisis in 2007? Be sure to address the role securitization played and how it affected regulators

What will be an ideal response?

The three critical factors were the evolution of new and innovative financial products, the integration of financial markets globally combined with the high rates of savings that were coming out of markets that had not participated significantly in the past, and deregulation. New and innovative financial products evolved including securitization, where large numbers of loans are grouped together and shares of the package are sold to virtually anyone, anywhere. These crossed borders easily and the purchasers lose money if the loans cannot be repaid, but it was often difficult to accurately access risk and for regulators to understand and to keep up with the innovations. In general, there was a failure in regulation as the tremendous amount of innovation of instruments and integration of markets evolved. Close regulation was generally not perceived to be in the national interest as it would reduce innovation and efficiency.

You might also like to view...

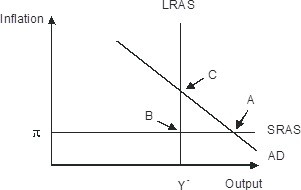

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

Which type of industry is likely to see more intraindustry trade?

What will be an ideal response?

The value of the estimated transformation parameter in generalized least square estimation that eliminates serial correlation in error terms indicates whether the estimates are likely to be closer to the pooled OLS or the fixed effects estimates.

Answer the following statement true (T) or false (F)

Quotas are most often supported by

A) foreign producers. B) foreign consumers. C) domestic consumers. D) domestic producers.