A U.S. retailer buys shoes from an Italian company. The Italian firm then uses all of the revenues to buy leather from the U.S. These transactions

a. increase both U.S. net exports and U.S. net capital outflow.

b. decrease both U.S. net exports and U.S. net capital outflow.

c. increase U.S. net exports and do not affect U.S. net capital outflow.

d. None of the above is correct.

d

You might also like to view...

In general, stocks are _________ risky than bonds, and have a _________ rate of return.

A. more; higher B. more; lower C. less; higher D. less; lower

Which of the following is true of a tariff?

a. It is a tax levied by the government on domestic production of goods and services. b. It is a quantitative restriction on imports imposed by the government. c. It is a monetary benefit received by exporters from the government. d. It is a monetary benefit received by importers from the government. e. It is a tax on import and export levied by the government.

When the required reserve ratio is 20 percent, the money multiplier is:

A. 0.2. B. 2. C. 2.5. D. 5.

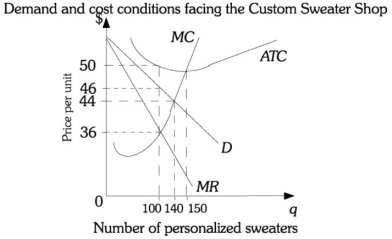

Refer to the information provided in Figure 15.5 below to answer the question(s) that follow.  Figure 15.5 Refer to Figure 15.5. Assume The Custom Sweater Shop has fixed costs of $500 and is a monopolistically competitive firm. At the profit-maximizing output in the short run, the firm ________ of $46.

Figure 15.5 Refer to Figure 15.5. Assume The Custom Sweater Shop has fixed costs of $500 and is a monopolistically competitive firm. At the profit-maximizing output in the short run, the firm ________ of $46.

A. earns a profit B. should set a price C. has an average total cost D. has an average variable cost