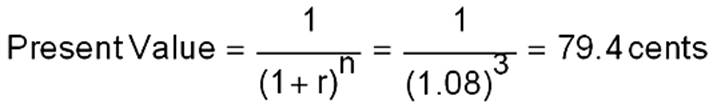

If the interest rate is 8% and $1 will be paid to you in 3 years, what is the present value of that dollar (to the nearest tenth of a cent)?

What will be an ideal response?

You might also like to view...

Which of the following is characteristic of a monopolistically competitive firm?

a. The firm faces an upward-sloping demand curve. b. The firm faces an inelastic demand curve. c. The firm faces a horizontal demand curve. d. The firm produces a differentiated product.

Exhibit 6-2 Cost schedule for pizza production Pizzas LaborCost EnergyCost MaterialsCost 0 $10 $ 0 $ 0 1 10 12 4 2 24 22 8 3 40 30 12 4 60 36 16 5 90 40 20 Exhibit 6-2 shows the labor, energy, and materials cost of making various quantities of pizzas. The table shows that the labor cost of making pizzas will:

A. increase at a decreasing rate. B. decrease at a decreasing rate. C. decrease at an increasing rate. D. increase at an increasing rate.

(Last Word) A market for human organs (rather than the current volunteer-donor system) would be expected to:

A. reduce the price of organs. B. create a surplus of organs. C. reduce the supply of organs. D. eliminate the shortage of organs.

Other things equal, an increase in input prices will:

A. reduce aggregate supply and reduce real output. B. increase the interest rate and lower the international value of the dollar. C. increase aggregate supply and increase the price level. D. increase net exports, increase investment, and reduce aggregate demand.