Suppose the economy was in equilibrium, and the national government increased spending by $200 billion. Monetarist theory would predict that the:

a. Long-term real GDP growth rate will rise.

b. Long-term real GDP growth rate will fall.

c. Long-term real GDP growth rate will remain unchanged.

d. Long-term inflation rate will fall.

e. The international value of the domestic currency will fall.

.C

You might also like to view...

In late 2010 the National Bank of Australia offered a 4 percent interest rate on a savings account while Bank of America offered 2 percent. This difference means that

A) people expect the U.S. dollar to appreciate to 8 percent against the Australian dollar and interest rate parity to occur. B) there will be a surplus of U.S. dollars in the foreign exchange market. C) people expect the U.S. dollar to appreciate by 2 percent against the Australian dollar and interest rate parity to occur. D) there will be a shortage of Australian dollars in the foreign exchange markets.

The above figure shows Bob's utility function. He currently has $100 of wealth, but there is a 50% chance that it could all be stolen. To reduce the chance of theft to zero, Bob is willing to pay

A) $20. B) $50. C) $70. D) $80.

If the Fed purchases government securities in the open market, _____

a. the money supply will decrease b. the money supply will increase only if the seller of those securities is a commercial bank c. the money demand will increase immediately d. the money demand will decrease immediately e. the money supply will increase through the commercial banking system regardless of who the seller is

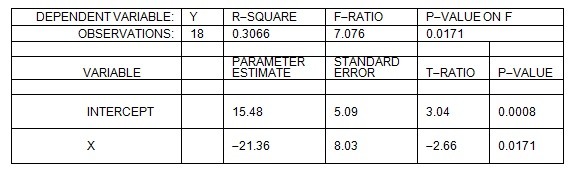

The linear regression equation, Y = a + bX, was estimated. The following computer printout was obtained:  Given the above information, if X equals 20, what is the predicted value of Y?

Given the above information, if X equals 20, what is the predicted value of Y?

A. -186.42 B. 186.42 C. -411.72 D. 165.69