If the face value of a bond is $5,000 and the coupon is $200, what is the interest rate?

What will be an ideal response?

The interest rate, or coupon rate, on a bond is calculated by dividing the coupon by the face value of the bond. In this case, the interest rate is $200 / $5,000 = 4%.

You might also like to view...

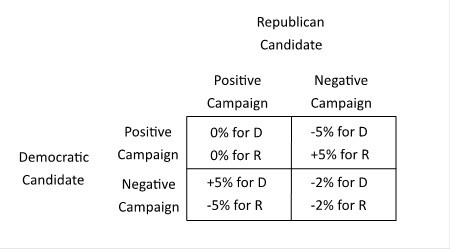

The table below shows how the payoffs to two political candidates depend on whether the candidates run a positive or negative campaign. The payoffs are given in terms of the percentage change in the number of votes received.  Suppose that the Republican candidate tells the Democratic candidate that he intends to run a positive campaign. The likely result is that:

Suppose that the Republican candidate tells the Democratic candidate that he intends to run a positive campaign. The likely result is that:

A. the Republican candidate will run a positive campaign, and the Democratic candidate will run a negative campaign. B. both candidates will run a negative campaign. C. the Republican candidate will run a negative campaign, and the Democratic candidate will run a positive campaign. D. both candidates will run a positive campaign.

Over the past 20 years, foreign financial investment in the United States has

A) increased significantly. B) decreased significantly. C) remained fairly consistent. D) become negative.

In economics, physical capital includes

A) money. B) bank accounts. C) machinery. D) shares of stock.

If the world price is above the domestic "no-trade" equilibrium price, then with international trade, the shortage caused in the domestic market can be met by foreign imports

a. True b. False Indicate whether the statement is true or false