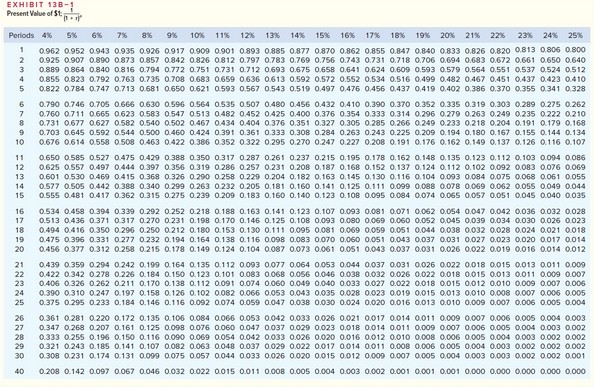

Mester Corporation has provided the following information concerning a capital budgeting project: After-tax discount rate 15?%Tax rate 30?%Expected life of the project 4? Investment required in equipment$100,000? Salvage value of equipment$0? Annual sales$205,000? Annual cash operating expenses$140,000? One-time renovation expense in year 3$25,000? Use Exhibit 13B-1 above to determine the appropriate discount factor(s). The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital

Mester Corporation has provided the following information concerning a capital budgeting project: After-tax discount rate 15?%Tax rate 30?%Expected life of the project 4? Investment required in equipment$100,000? Salvage value of equipment$0? Annual sales$205,000? Annual cash operating expenses$140,000? One-time renovation expense in year 3$25,000? Use Exhibit 13B-1 above to determine the appropriate discount factor(s). The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital

budgeting.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

A. $39,853

B. $139,853

C. $41,956

D. $94,500

Answer: A

You might also like to view...

The ability of any stockholder to transfer stock to another person without the knowledge or the consent of the other stockholders and without disturbing the normal activities of the corporation is called

a. unlimited life. b. suitability for large scale operations. c. taxation of corporate earnings. d. transferable ownership units.

When an entity's revenues exceed its expenses for a period of time, the entity will report net income

a. True b. False Indicate whether the statement is true or false

Too many territories lead to salespeople fighting over the geographic boundaries

Indicate whether the statement is true or false

An excess of income taxes expense over income taxes payable for a period is associated with a(n)

a. excess of taxable income over accounting income. b. error. c. debit to the Deferred Income Taxes account. d. excess of accounting income over taxable income.