Which of the following is not true about government taxation?

a. It is an indirect way to shift resources.

b. It is free of opportunity costs.

c. Taxes are levied on both citizens and businesses.

d. Taxes are unequally levied among citizens.

e. Taxes are a tool for debt reduction.

B

You might also like to view...

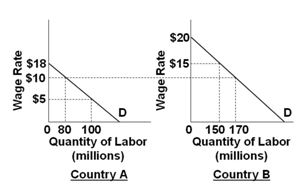

Refer to the below graphs. (Assume that the pre-migration labor force in Country A is 100 and that it is 150 in country B.) The migration of labor will:

A. Increase wages in country A and decrease wages in country B

B. Decrease wages in country A and decrease wages in country B

C. Decrease wages in country A and increase wages in country B

D. Increase wages in country A and increase wages in country B

One of the risks of maturity transformation is that:

A) it can increase the rate of inflation. B) it reduces the profitability of banks. C) it can lead to bank runs. D) it discourages savings.

What factors should be considered in determining whether a firm should sell to buyers in a foreign country by exporting from its home country or by setting up local production in the foreign country to produce the products that are sold to the foreign consumers? When identifying these factors, clearly explain how and why they push the decision toward one or the other of the two available choices.

What will be an ideal response?

A monopoly will look for opportunities to price discriminate because the practice

A. leads to greater profits. B. allows it to charge higher prices. C. leads to selling more units. D. is desired by customers.