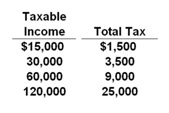

The following data represent a personal income tax schedule. Answer the question on the basis of this information. Refer to the below table. As income increases, the average tax rate:

A. Increases

B. Decreases

C. Remains constant

D. Has no definite pattern

A. Increases

You might also like to view...

Why are some insurance companies interested in programs for nationwide disaster insurance for floods, earthquakes, and hurricanes?

What will be an ideal response?

The demand curve shifts rightward from D0 to D1 when the U.S. interest rate ________ and foreign interest rates are unchanged. The demand curve shifts rightward from D0 to D1 when the expected future exchange rate ________

A) falls; rises B) rises; rises C) falls; falls D) rises; falls E) None of the above answers is correct because the factors mentioned lead to movements along the demand curve and not to shifts of the demand curve.

The figure above shows the demand for fruit snacks. Which movement reflects a decrease in population?

A) from point a to point e B) from point a to point b C) from point a to point c D) from point a to point d

Which of the following is true about a risk-averse individual facing a full menu of actuarily fair insurance contracts to choose from?

A. The individual will "over-insure" if consumption is more meaningful in the good state. B. The individual will "over-insure" if consumption is more meaningful in the bad state. C. The individual will fully insure when tastes are state-independent. D. (a) and (b) are true. E. (a) and (c) are true. F. (b) and (c) are true. G. All of the above. H. None of the above.