Briefly explain how changes in individual income tax rates would affect aggregate demand. Give an example.

What will be an ideal response?

Student examples will vary. A sample answer follows. A change in taxes has an indirect effect on aggregate demand. For example, an increase in the individual income tax can reduce disposable income and decrease consumer spending. Similarly, a decrease in the individual income tax can increase disposable income and lead to an increase in consumer spending. For example, suppose that Rajah has a taxable income of $50,000, and he pays 15% on the first $30,000 and 20% on anything over that. His income tax would be $8,500. If his marginal tax rate increases to 25%, his income tax increases to $9,500, and he will have $1,000 a year less to spend on goods and services. If everyone in the country had a similar reduction in disposable income, the aggregate demand would drop significantly. The aggregate demand curve would shift to the left.

You might also like to view...

Adriana wants to try working as an independent contractor this summer. She has a 50 percent chance that she will make $9,000 and 50 percent chance that she will make nothing. Her utility of wealth curve is shown in the figure above

What's Adriana's cost of risk? A) $2,500 B) $2,000 C) zero D) $40

In the figure above, compared to a perfectly competitive industry with the same costs, a single-price, unregulated monopoly will decrease production by

A) zero. B) 2 units per day. C) 4 units per day. D) 6 units per day.

Countries with the

A) biggest deflations and output contractions are countries which were never on the gold standard until 1936. B) biggest inflations and output contractions are countries which were on the gold standard until 1936. C) lowest deflations and output contractions are countries which were on the gold standard until 1936. D) biggest deflations and output increases are countries which were on the gold standard until 1936. E) biggest deflations and output contractions are countries which stayed on the gold standard until 1936.

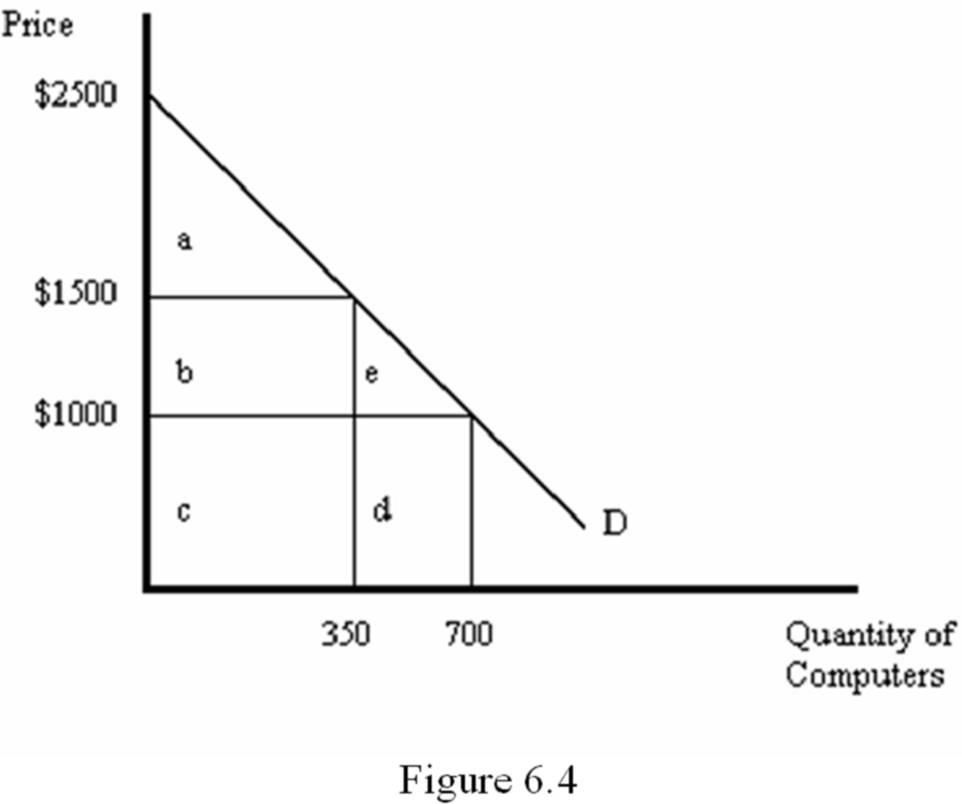

Refer to Figure 6.4. If the price of computers is $1,500, then consumer surplus is equal to:

A. $175,000.

B. $535,000.

C. $1,000.

D. $262,500.