The U-pick berry market is perfectly competitive. Suppose that all U-pick blueberry farms have the same cost curves and all are making an economic profit. What happens as time passes? What is the long-run equilibrium outcome?

What will be an ideal response?

The presence of economic profit attracts new firms into the U-pick blueberry market. As the new firms, that is, new farmers enter the market, the supply of U-pick blueberries increases. The increase in the supply drives the price lower and decreases the economic profits of the existing farmers. New farmers continue to enter the market as long as there is the possibility of making an economic profit. Eventually enough new firms enter so that the price is driven so low that the economic profit is eliminated. All the firms earn zero economic profit, which keeps them in business but provides no incentive for new firms to enter the market. At this point, the long-run equilibrium has been reached.

You might also like to view...

The Fed's policy tools include all the following except _______

A. required reserve ratio and open market operations B. quantitative easing C. discount rate D. taxing banks' deposits at the Fed

We have drawn the SAS and SP curves as straight lines for convenience. More realistically, rising output ________ the structural unemployment problem and the effect of this on wages causes those curves to ________ in slope

A) aggravates, increase B) aggravates, decrease C) alleviates, increase D) alleviates, decrease

If import restrictions prohibit foreigners from selling various goods and services in the U.S. market,

What will be an ideal response?

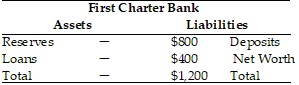

Refer to the information provided in Table 25.1 below to answer the question(s) that follow.Table 25.1 Refer to Table 25.1. The required reserve ratio is 25%. If the First Charter Bank is meeting its reserve requirement and has no excess reserves, its loans equal

Refer to Table 25.1. The required reserve ratio is 25%. If the First Charter Bank is meeting its reserve requirement and has no excess reserves, its loans equal

A. $1,800. B. $1,000. C. $900. D. $600.