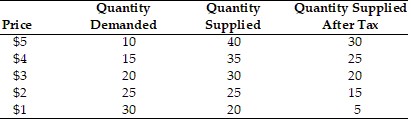

Using the above table, a unit tax of $2 is imposed on the product. The equilibrium price of this product after the tax is imposed is

Using the above table, a unit tax of $2 is imposed on the product. The equilibrium price of this product after the tax is imposed is

A. $2.

B. $3.

C. $4.

D. $5.

Answer: B

You might also like to view...

The three broad reasons for saving, as identified by economists, relate to:

A. the life-cycle, precaution, and bequests. B. national, public, and private production. C. capital gains, capital losses, and deficits. D. consumption, investment, and exports.

In an open economy, private saving, , is equal to

A) I - CA + (G - T). B) I + CA - (G - T). C) I + CA + (G - T). D) I - CA - (G - T). E) I + CA + (G + T).

Which of the following contributes to income inequality?

a. unequal abilities b. unequal ownership of property c. discrimination d. All of these.

If a large percentage increase in the price of a good results in a small percentage increase in the quantity supplied of the good, supply is said to be

a. horizontal. b. relatively inelastic. c. relatively elastic. d. income proof.