If Aisha were to get a $3,000 bonus from her employer, which of the following tax rates would most accurately reflect the percent of this additional income that she would owe in taxes?

a. her marginal tax rate

b. her average tax rate

c. her progressive tax coefficient

d. the rate of excess burden

A

You might also like to view...

In the case of a specific tax the resulting price received by producers depends on

A) who pays the tax. B) the price elasticity of supply. C) the price elasticity of demand. D) All of the above.

According to the innovation theory of profit, above-normal profits are necessary to compensate the owners of the firm for the risk they assume when making their investments

a. true b. false

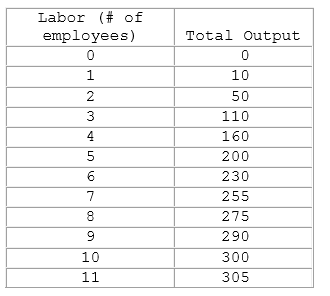

Assume the table shown is for a hat factory, and shows the total production of hats given various numbers of employees. Diminishing marginal product sets in with the:

A. fourth worker.

B. third worker.

C. fifth worker.

D. second worker.

Exhibit 12-1 Income for two persons NameIncome Elaine$100,000 Daniel$ 40,000 In Exhibit 12-1, if the income tax system is progressive, then:

A. Elaine and Daniel will face the same tax rate and will have tax bills the same size. B. Elaine and Daniel will face the same tax rate but have tax bills that are different sizes. C. Elaine will face a higher tax rate and will have a larger tax bill than Daniel. D. Elaine will face a lower tax rate and will have a smaller tax bill than Daniel.