A sin tax is an example of:

A. a Pigovian tax.

B. government policy increasing total surplus in a market.

C. a tax that increases the efficiency of a market.

D. All of these statements are true.

D. All of these statements are true.

You might also like to view...

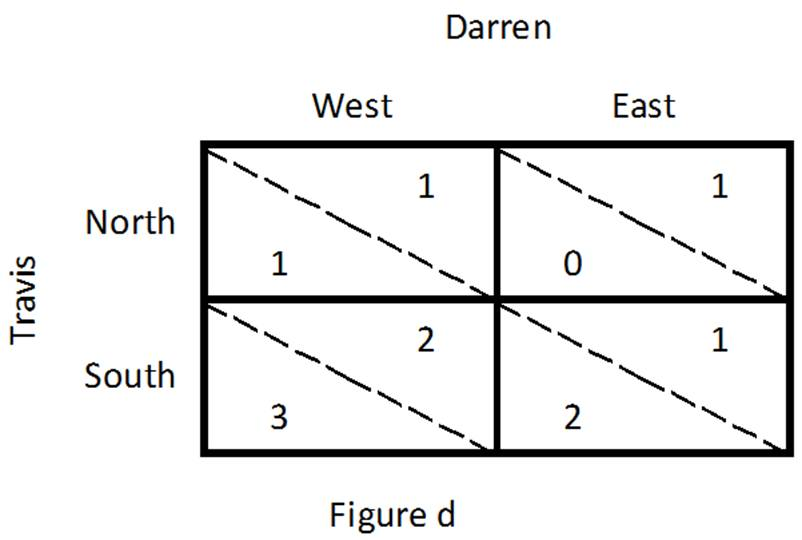

Refer to Figure d, which illustrates a game played by Travis and Darren. What is the Nash equilibrium?

A. Travis chooses North, Darren chooses East

B. Travis chooses North, Darren chooses West

C. Travis chooses South, Darren chooses East

D. Travis chooses South, Darren chooses West

In a competitive price-searcher market, the marginal revenue of the firm will always be

a. a horizontal line. b. greater than price. c. less than price. d. equal to price.

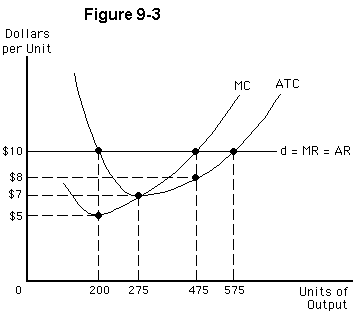

If a perfectly competitive firm like the one depicted in Figure 9-3 produces 275 units

a.

its profit will be larger than if it produces only 475

b.

its profit will be exactly the same as if it produces 475

c.

its profit will be smaller than if it produces only 475

d.

it will be forced to shutdown

e.

its profit will be smaller than if it produced 475 but it will still make a profit.

Discuss the impact of demand and supply changes on market equilibrium price and quantity. Express this graphically.

What will be an ideal response?