How has the share of the personal income tax paid by the rich (the top 1 percent of earners) and the not-so-well-off (the bottom half of earners) changed during the last four decades?

a. The rich now pay a larger share and the not-so-well-off pay a smaller share of the personal income tax.

b. The rich now pay a smaller share and the not-so-well-off pay a larger share of the personal income tax.

c. The share of the personal income tax paid by the rich increased between 1960 and 1980, but the share of the revenues collected from the rich has declined sharply since 1980.

d. The relative shares paid by the rich and the not-so-well-off have been virtually unchanged during the last four decades.

A

You might also like to view...

The opportunity cost of any action is

A) all the possible alternatives given up. B) the highest-valued alternative given up. C) the benefit from the action minus the cost of the action. D) the dollars the action cost.

According to the law of demand, when the price of a BMW or a Gucci purse increases, the quantity demanded of these goods will also increase because consumers consider them prestigious

a. True b. False Indicate whether the statement is true or false

To maximize progress toward a political goal, the "rational terrorist" will always choose those actions for which the

A. most money is lost. B. most people die. C. fewest innocent people die. D. marginal benefit equals or exceeds the marginal cost.

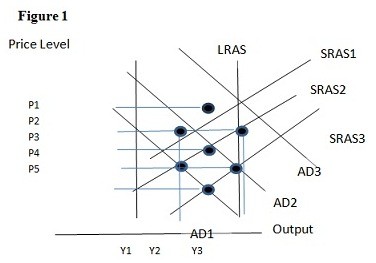

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.