Interest-rate risk can best be characterized as the risk that

A) you could have earned a higher interest rate if you waited to purchase a bond.

B) fluctuations in the price of a financial asset in response to changes in market interest rates.

C) you could have gotten a lower interest rate if you waited to lock in a mortgage.

D) short-term interest rates may exceed long-term interest rates.

B

You might also like to view...

Under perfect competition, if an industry is characterized by positive economic profits in the short run

a. firms will leave the market in the long run and the short-run supply curve will shift outward. b. firms will enter the market in the long run and the short-run supply curve will shift outward. c. firms will enter the market in the long run and the short-run supply curve will shift inward. d. firms will leave the market in the long run and the short-run supply curve will shift inward.

Most economists believe that in the short run

a. real and nominal variables are determined independently and that money cannot move real GDP away from its long-run trend. b. real and nominal variables are determined independently but that money can temporarily move real GDP away from its long-run trend. c. real and nominal variables are highly intertwined but that money cannot move real GDP away from its long-run trend. d. real and nominal variables are highly intertwined and that money can temporarily move real GDP away from its long-run trend.

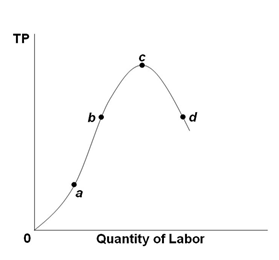

Refer to the graph below. It shows the total product (TP) curve. At which point is the marginal product zero?

A. Point a

B. Point b

C. Point c

D. Point d

One of the limiting factors for using monetary policy is:

A. the real interest rate cannot fall below zero. B. central banks are limited in their ability to make loans. C. the central banks are limited in their ability to print money. D. there is a lower nominal-interest-rate bound of zero.