A bank has $500,000 in deposits and $475,000 in loans. It has loaned out all it can. It has a reserve ratio of

a. 2.5 percent.

b. 5 percent.

c. 9.5 percent.

d. 25 percent.

b

You might also like to view...

Media reports often suggest that the increasing public debt is a burden on future generations. What they mean is that

A) it reduces the current level of investment. B) it makes predicting future unemployment levels unpredictable. C) it causes deflation. D) it reduces both nominal and real interest rates.

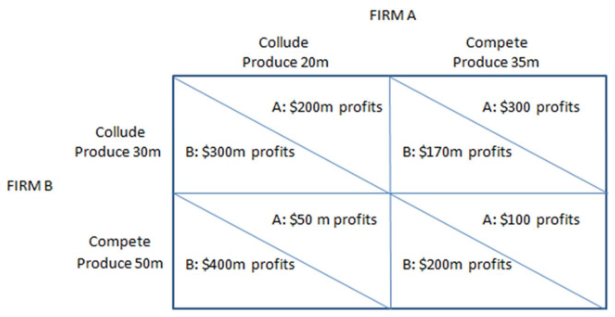

Given the situation in the matrix shown, we can predict that Firm A's profits will be:

This prisoner's dilemma game shows the payoffs associated with two firms, A and B, in an oligopoly and their choices to either collude with one another or not.

A. $50 million.

B. $100 million.

C. $200 million.

D. $300 million.

If the rate of interest increases, firms will most likely respond by: a. increasing investment

b. decreasing investment. c. not changing investment. d. increasing their capital stock.

The demand curve facing a firm

a. indicates the quantity of output that customers will purchase from that firm, at various prices b. shows the minimum cost of producing any level of output c. is drawn assuming that the firm is operating in the short run d. indicates how much output a profit-maximizing firm will produce, at various prices e. is downward sloping because consumers have less money to spend, the more output they purchase