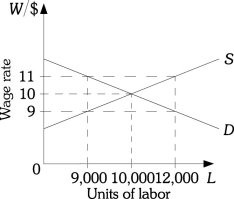

Refer to the information provided in Figure 28.2 below to answer the question(s) that follow. Figure 28.2Refer to Figure 28.2. Assume that the productivity of workers increases as the wage rate increases. The efficiency wage

Figure 28.2Refer to Figure 28.2. Assume that the productivity of workers increases as the wage rate increases. The efficiency wage

A. would equal $10.

B. could either be above or below $10.

C. would be above $10.

D. would be below $10.

Answer: C

You might also like to view...

An adverse supply shock would

A) shift the production function up and decrease marginal products at every level of employment. B) shift the production function down and decrease marginal products at every level of employment. C) shift the production function down and increase marginal products at every level of employment. D) shift the production function up and increase marginal products at every level of employment.

The notion that equally situated individuals should be taxed equally is referred to as

A. horizontal equity. B. vertical equity. C. the benefits principle. D. the Gini principle.

How does the tax code contribute to rising health care costs?

A. Since the tax code provides exemptions for research and development, it provides an incentive for businesses to develop high-tech and expensive new treatments. B. Since services are not subject to state sales taxes, households tend to spend more of their money on health care services than on other goods. C. Since health care purchases are subject to such high taxes, total spending on health care (including taxes) is quite high. D. Since health insurance benefits are untaxed, workers have an incentive to receive more of their compensation in the form of health insurance benefits.

Firms that are "breaking even" are

A. shutting down in the short run. B. earning less than a normal rate of return. C. earning zero economic profits. D. All of the above are correct.