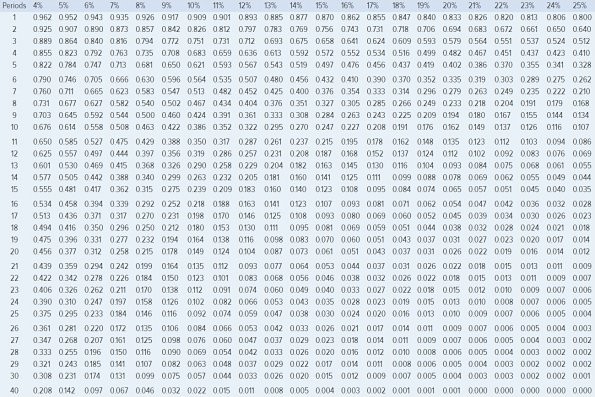

Exhibit 7B-1 Present Value of $1;

A company anticipates incremental net income (i.e., incremental taxable income) of $20,000 in year 3 of a project. The company's tax rate is 30% and its after-tax discount rate is 8%.Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.The present value of this future cash flow is closest to:

A company anticipates incremental net income (i.e., incremental taxable income) of $20,000 in year 3 of a project. The company's tax rate is 30% and its after-tax discount rate is 8%.Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.The present value of this future cash flow is closest to:

A. $6,000

B. $4,763

C. $11,116

D. $14,000

Answer: C

You might also like to view...

The ability to make ethical choices is related to a person’s level of ______ development.

A. safety B. security C. mature D. moral

Product cost are also called inventoriable cost

Indicate whether the statement is true or false

With reference to the United States Bankruptcy Code, which of the following is a disadvantage of bankruptcy to creditors?

A) Continued operation results in less funds to distribute at liquidation. B) The going-concern value of an insolvent business is not preserved. C) Creditor-in-possession is held accountable due to bankruptcy reporting and notice requirements. D) A creditor cannot file an involuntary petition for relief under Chapter 7.

The days to collect receivables increased from 32 days last year to 48 days this year. Which of the following statements is correct?

A. The company is likely to see its Bad Debt Expense decrease. B. The receivables turnover rate decreased from approximately 11.4 to 7.6 from last year to this year. C. The company is becoming more efficient at collecting payment. D. The receivables turnover rate must have increased from last year to this year.