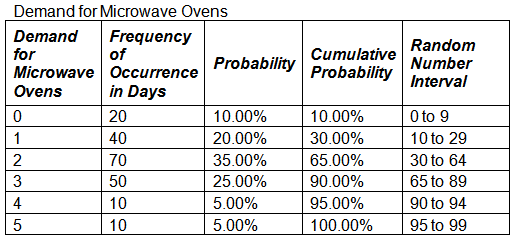

Consider the Demand for Microwave Ovens dataset. What is the total demand corresponding to random numbers 44, 84, 15, 96, 86, and 41?

a. 14

b. 15

c. 16

d. 17

c. 16

You might also like to view...

The equivalent of a storefront for a Web retailer is _____

a. a search engine b. the Web browser c. its home page d. the checkout

An overhead cost variance is the difference between the total overhead actually incurred for the period and the standard overhead applied to products.

Answer the following statement true (T) or false (F)

Pettijohn Inc.The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

Balance Sheet (Millions of $) Assets2016 Cash and securities$ 1,554.0 Accounts receivable9,660.0 Inventories 13,440.0 Total current assets$24,654.0 Net plant and equipment 17,346.0 Total assets$42,000.0 Liabilities and Equity Accounts payable$ 7,980.0 Notes payable5,880.0 Accruals 4,620.0 Total current liabilities$18,480.0 Long-term bonds 10,920.0 Total liabilities$29,400.0 Common stock3,360.0 Retained earnings 9,240.0 Total common equity$12,600.0 Total liabilities and equity$42,000.0 Income Statement (Millions of $)2016 Net sales$58,800.0 Operating costs except depr'n$55,274.0 Depreciation$ 1,029.0 Earnings bef int and taxes (EBIT)$ 2,497.0 Less interest 1,050.0 Earnings before taxes (EBT)$ 1,447.0 Taxes$ 314.0 Net income$ 1,133.0 Other data: Shares outstanding (millions)175.00 Common dividends$ 509.83 Int rate on notes payable & L-T bonds6.25% Federal plus state income tax rate21.7% Year-end stock price$77.69 Refer to the data for Pettijohn Inc. What is the firm's profit margin? A. 1.40% B. 1.56% C. 1.73% D. 1.93% E. 2.12%

Daniel acquires a 30 percent interest in the PPZ Partnership from Paolo, an existing partner, for $39,000 of cash. The PPZ Partnership has borrowed $10,000 of recourse liabilities as of the date Daniel bought the interest. What is Daniel's basis in his partnership interest?

A. $39,000. B. $42,000. C. $49,000. D. $46,000.