The U.S. fiscal stimulus in 2009 did not increase GDP substantially because

A. the Federal Reserve was decreasing interest rates and real-world estimates for the multiplier might be less than one.

B. the Federal Reserve was increasing interest rates and real-world estimates for the multiplier might be less than one.

C. state governments were decreasing spending and real-world estimates for the multiplier might be less than one.

D. state governments were increasing spending and real-world estimates for the multiplier might be less than one.

Answer: C

You might also like to view...

Refer to Figure 4-18. What is the size of the unit tax?

A) $8 B) $5 C) $3 D) cannot be determined from the figure

Economist Charles Kindleberger (a proponent of fixed exchange rates mentioned in the text) would agree with which of the following statements?

A) It is better to leave the international value of the domestic currency to the free market forces than to have to sacrifice domestic economic goals in order to support a certain predetermined value of the currency. B) There is too great a chance that the supported exchange rates will diverge significantly from the equilibrium exchange rates, which would create persistent problems and lead to an overall decrease in international trade. C) With no certainty of what one nation's currency will be worth in terms of other nations' currencies, international trade is held below what it could be. D) a and b

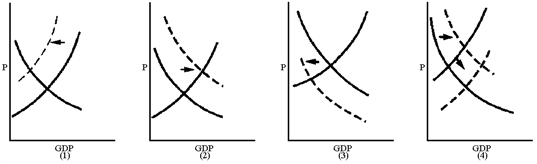

Figure 11-2

Which graph in Figure 11-2 best reflects a Keynesian view of the impact of a $500-per-person tax cut?

a.

1

b.

2

c.

3

d.

4

Which statement is true?

A. Most monopolistic competitors are large firms. B. Monopolistic competitors produce goods or services for which there are no close substitutes. C. Monopolistic competitors usually operate at the minimum point of their average total cost curves. D. None of these statements are true.