Unrealized gains and losses are reported as other comprehensive income items until the related securities are sold, then the gains and losses become realized and are included in determining net income

Indicate whether the statement is true or false

True

You might also like to view...

Which of the following statements is true of the U.S. economy?

A. In the second half of the 1960s, the output gap was mostly negative while in the first half of the 1990s, the output gap was mostly positive. B. In the second half of the 1960s, the output gap was mostly positive while in the first half of the 1990s, the output gap was mostly negative. C. In the second half of the 1960s and the first half of the 1990s, the output gap was mostly negative. D. In the second half of the 1960s and the first half of the 1990s, the output gap was mostly positive.

Use this information to answer the following question. The general ledger account for Accounts Receivable shows a debit balance of $50,000 . Allowance for Uncollectible Accounts has a credit balance of $1,000 . Net sales for the year were $522,000 . In the past, 2 percent of sales have proved uncollectible, and an aging of accounts receivable accounts results in an estimate of $13,500 of

uncollectible accounts. Using the percentage of net sales method, Uncollectible Accounts Expense would be debited for a. $9,440. b. $11,440. c. $1,000. d. $10,440.

Firms initially record trading securities at fair value, excluding transactions costs (which firms expense as they incur them)

Indicate whether the statement is true or false

At the end of July, NWC wishes to have no recruits or apprentices but at least 140 full-time workers. Formulate and solve a linear program for NWC to accomplish this at minimum total cost.

National Wing Company (NWC) is gearing up for the new B-48 contract. Currently, NWC has 100 equally qualified workers. Over the next three months, NWC has made the following commitments for wing production:

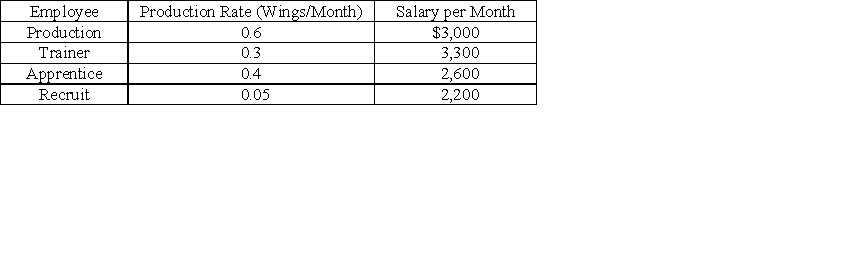

Each worker can either be placed in production or train new recruits. A new recruit can be trained to be an apprentice in one month. The next month, he, himself, becomes a qualified worker (after two months from the start of training). Each trainer can train two recruits. The production rate and salary per employee are estimated below.