An economic rationale for government protection of small investors is that:

A. many small investors cannot adequately judge the soundness of their bank.

B. there is inadequate competition to ensure a bank is operating efficiently.

C. banks are often run by unethical managers who will often exploit small investors.

D. large investors can better afford losses.

Answer: A

You might also like to view...

50% of the national income in an economy goes to labor. If this economy has a Cobb-Douglas production function, ________ of its national income should go to capital

A) 50% B) 15% C) 20% D) 30%

Because there is an imbalance of information in a lending situation, we must deal with the problems of adverse selection and moral hazard. Define these terms and explain how financial intermediaries can reduce these problems

What will be an ideal response?

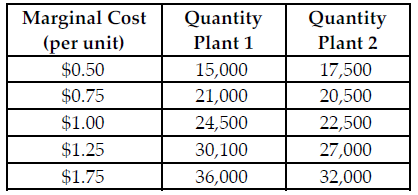

Refer to the table below. If Sweet Grams is a perfectly competitive firm and the market price $1.25 per unit, what is the profit-maximizing quantity for Sweet Grams to produce at Plant 2?

Sweet Grams makes graham cracker snack packages. Sweet Grams is a multi-plant firm with two production facilities. The above table summarizes the total marginal cost of production at various output levels in the separate plants. Assume Sweet Grams is a perfectly competitive firm.

A) 32,000

B) 30,100

C) 27,000

D) 22,500

What do we know about service failures?

a. Statistics show that out-of-stock occurrences have reduced retailer's overall sales by four percent b. Costs of stockouts are not shared equally among members of the supply chain c. Calculating the true cost of a stockout is very difficult d. All of the above