Which of the following is not a function of the Fed?

a. To supervise and regulate banks.

b. Dealing with financial crises.

c. To print currency.

d. Check clearing.

e. Acting as a "bank for banks".

C

You might also like to view...

The most effective mechanism for reducing runs on banks is _____

a. the discount rate b. deposit insurance c. the reserve requirement d. open-market operations e. the Federal Reserve note

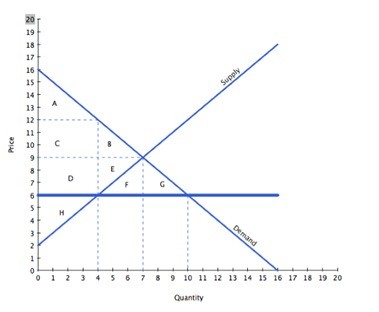

With reference to the graph above, if the intended aim of the price ceiling set at $6 was a net increase in the well-being of consumers:

With reference to the graph above, if the intended aim of the price ceiling set at $6 was a net increase in the well-being of consumers:

A. then the policy was ineffective since consumers gained in surplus overall. B. then the policy was effective since consumers lost surplus overall. C. then the policy was ineffective since consumers lost surplus overall. D. then the policy was effective since consumers gained in surplus overall.

A congress member concerned about ensuring vertical equity in taxation would be most likely to argue for obtaining government revenue through a

A. progressive tax on personal income. B. regressive tax on corporate income. C. sales tax. D. head tax.

The use of spending and taxes by the government to influence aggregate demand is known as

A. monetary policy. B. governmental policy. C. administrative policy. D. fiscal policy. E. federal policy.