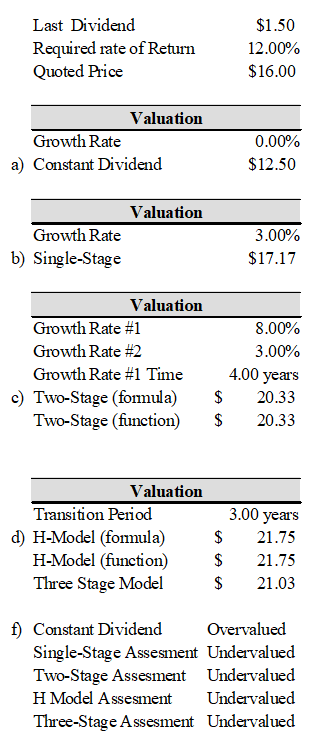

Determine the price of a share of stock whose last annual dividend payment (D0) was $1.50, assuming a required rate of return of 12% and considering the following:

a) The dividend payment is expected to remain constant (i.e., g = 0) indefinitely.

b) The dividend payment is expected to grow at a constant rate of 3% per year indefinitely.

c) The dividend payment is expected to grow at a rate of 8% for four years and then immediately decline to 3% indefinitely. Calculate your solution twice, the first time using formula 9-5 on page 260, and the second time using the FAME_TwoStageValue user-defined function.

d) The dividend payment is expected to grow at a rate of 8% for four years and then gradually decline over a three year transition period to 3% indefinitely. Calculate your solution twice, first time using formula 9-8 on page 264, and the second time using the FAME_HModelValue user-defined function.

e) Using the same assumptions as in part d, calculate the value of the stock using the FAME_ThreeStageModel user-defined function.

f) How do the calculated intrinsic values compare to the current price of $16? Use an IF statement to display whether the stock is undervalued, overvalued, or fairly valued.

You might also like to view...

If tastes and preferences are identical for two trading nations, then comparative advantage is the result of

a. technological conditions of the two nations. b. income levels of the two nations. c. demand conditions of the two nations. d. supply conditions of the two nations.

If a bank compounds savings accounts quarterly, the nominal rate will exceed the effective annual rate.

Answer the following statement true (T) or false (F)

Which combination of communication styles between salesperson and customer will likely result in a good relationship, but will LEAST likely lead to a firm sale?

A) directive salesperson with directive customer B) directive salesperson with supportive customer C) supportive salesperson with supportive customer D) supportive salesperson with reflective customer E) reflective salesperson with emotive customer

In an inflationary environment, the use of which of the following cost flow methods would result in the least tax liability for the firm in the current period?

a. LIFO b. Weighted average cost c. FIFO d. Moving average cost