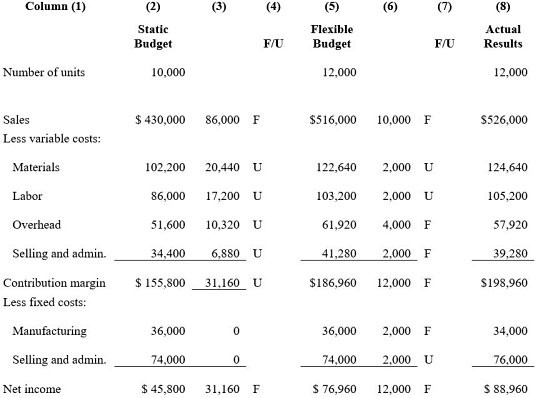

The Vermont Company has requested a performance report that reports both sales activity variances and flexible budget variances. The following table of information is provided: Static Budget Flexible Budget Actual Results?Number of units10,000 F/U 12,000 F/U 12,000?Sales$430,000 $516,000 $526,000 ?Less variable costs: ?Materials 102,200 122,640 124,640 ?Labor 86,000 103,200 105,200 ?Overhead 51,600 61,920 57,920 ?Selling and administrative 34,400 41,280 39,280 ?Contribution margin$155,800 $186,960 $198,960 ?Less fixed

costs: ?Manufacturing 36,000 36,000 34,000 ?Selling and administrative 74,000 74,000 76,000 ?Net income$45,800 $76,960 $88,960 ?? Required:(1) Compute and enter the variances and label the variances as favorable (F) or unfavorable (U).(2) Which variances are sales volume variance and which variances are flexible budget variances?(3) Comment on this company's performance.

What will be an ideal response?

1)

2) The sales volume variances are between the Static Budget and the Flexible Budget, and the flexible budget variances are between the Actual Results and the Flexible Budget.

3) From this report it appears that the primary causes for actual income being $12,000 above what it should have been are a higher selling price than expected and better control of variable materials and labor costs. It is not possible to be more specific without computing more detailed cost variances (i.e., price and quantity variances for materials, labor, and overhead).

You might also like to view...

The manager of safety, health services and benefits usually reports to the controller

Indicate whether the statement is true or false

Write the appropriate constraint for the following condition: If project 1 is chosen, project 5 must not be chosen

What will be an ideal response?

Mary Tappin, an assistant Vice President at Galaxy Toys, was disturbed to find on her desk a memo from her boss, Gary Resnick, to the controller of the company. The memo appears below:GALAXY TOYS INTERNAL MEMOSept 15To: Harry Wilson, ControllerFm: Gary Resnick, Executive Vice PresidentAs you know, we won't start recording many sales until October when stores start accepting shipments from us for the Christmas season. Meanwhile, we are producing flat-out and are building up our finished goods inventories so that we will be ready to ship next month.Unfortunately, we are in a bind right now since it looks like the net income for the quarter ending on Sept 30 is going to be pretty awful. This may get us in trouble with the bank since they always review the quarterly financial reports and may

call in our loan if they don't like what they see. Is there any possibility that we could change the classification of some of our period costs to product costs--such as the rent on the finished goods warehouse?Please let me know as soon as possible. The President is pushing for results.Mary didn't know what to do about the memo. It wasn't intended for her, but its contents were alarming.Required:a. Why has Gary Resnick suggested reclassifying some period costs as product costs?b. Why do you think Mary was alarmed about the memo? What will be an ideal response?

Amy stopped by the grocery store to pick up a gallon of milk. As she was waiting to check out she noticed that Soap Opera Digest had an interesting story about one of her favorite characters. As Amy is a huge fan of the long running soap, she had to buy a copy. In this example, the Soap Opera Digest is an example of a(n) _____ product.

A. specialty B. convenience C. business D. shopping E. unsought