Your friend works as a salaried employee of a large local corporation. She told you that she paid $2,592 when she filed her tax return, so her tax liability was equal to that amount. What is the fallacy in her statement?

What will be an ideal response?

In many respects, a tax return is the document that represents the "settling up" between the taxpayer and the government. The taxpayer lists all appropriate income and deductions, calculates tax liability and subtracts amounts already paid. At that point, the taxpayer may owe additional tax (total tax liability is greater than amounts paid) or may be entitled to a refund (amounts paid exceed the total tax liability). The liability of your friend is actually equal to the $2,592 she paid with her tax return plus the amount she paid as withholding taxes from her paycheck.

You might also like to view...

Perch Corporation has made paint and paint brushes for the past ten years. Perch Corporation is owned equally by Arnold, an individual, and Acorn Corporation. Perch Corporation has $100,000 of accumulated and current E&P. Both Arnold and Acorn Corporation have a basis in their stock of $10,000. Perch Corporation discontinues the paint brush operation and distributes assets worth $10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock. Due to the distribution, Arnold and Acorn Corporation must report:

A.

| Arnold | Acorn Corporation |

| $10,000 dividend | $8,000 capital gain |

B.

| Arnold | Acorn Corporation |

| $8,000 capital gain | $8,000 capital gain |

C.

| Arnold | Acorn Corporation |

| $8,000 capital gain | $10,000 dividend |

D.

| Arnold | Acorn Corporation |

| $10,000 dividend | $10,000 dividend |

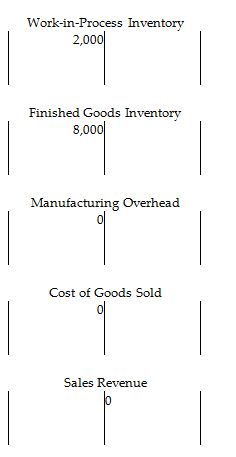

At the beginning of the year, Green Street Manufacturing had the following account balances:

The following additional details are provided for the year:

After adjusting the balance in Manufacturing Overhead, the ending balance in the Finished Goods Inventory account is a ________.

A) credit of $57,000

B) debit of $65,000

C) credit of $433,000

D) debit of $73,000

Many organizations utilize responsibility accounting

a. to assist in building performance measures for the organization. b. to assist in performance management and evaluation. c. solely to evaluate how well employees are handling their responsibilities. d. as an alternative to generally accepted accounting principles.

Which of the segmentation attractiveness criteria is assumed by the statement, "Build it, and they will come"?

What will be an ideal response?