Refer to the above table. Suppose the U.S. government (but not Europe) offers a $10 million subsidy?

What will be an ideal response?

In this case Airbus would decide not to enter the market since it knows Boeing will, and that therefore its own production will entail a loss of $5 million.

You might also like to view...

According to the Keynesian model, the short-run aggregate supply (SRAS) curve is horizontal when

A) prices react to an aggregate demand shock but real Gross Domestic Product (GDP) does not. B) there are no unemployed resources and wages do not change when prices change. C) there are unemployed resources and prices do not fall when aggregate demand falls. D) real Gross Domestic Product (GDP) is at full capacity but prices are not flexible.

Which of the following is a term referring to an unwritten agreement in the labor market that the employer will try to keep wages from falling when the economy is weak or the business is having trouble, and the employee will not expect huge salary increases when the economy or the business is strong?

a. efficiency wage theory b. relative wage coordination argument. c. implicit contract d. insider-outsider model

Bank reserves that exceed the reserve requirements set by the central bank are called:

A. required reserves. B. excess reserves. C. legal reserves. D. total reserves.

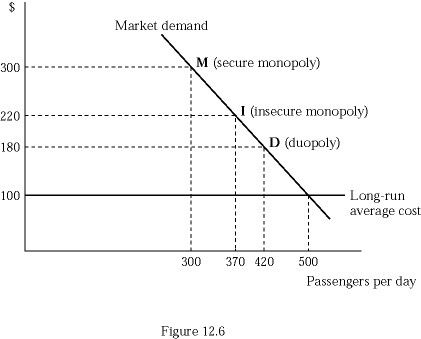

In Figure 12.6, airline Fly Smart is initially a secure monopoly between two cities X and Y at point M, serving 300 passengers per day at the profit maximizing price of $300 per ticket. Suppose that Fly Smart discovers that a second airline is contemplating entering the market. If the minimum market entry quantity is 130 passengers per day, what price should Smart Fly charge to secure the entry-deterring quantity?

In Figure 12.6, airline Fly Smart is initially a secure monopoly between two cities X and Y at point M, serving 300 passengers per day at the profit maximizing price of $300 per ticket. Suppose that Fly Smart discovers that a second airline is contemplating entering the market. If the minimum market entry quantity is 130 passengers per day, what price should Smart Fly charge to secure the entry-deterring quantity?

A. $300 B. $220 C. $180 D. $100