Dynaflex Corp. is considering an investment project that costs $900 today. It expects the project will yield income of $350 at the end of years 1, 2, and 3. If the interest rate is 10%, the firm

A. is just indifferent between undertaking the investment and not.

B. should forgo the investment.

C. should undertake the investment.

D. indeterminate from the given information

Answer: B

You might also like to view...

Marginal cost is the

a. change in total cost resulting from producing one more unit of output. b. change in total fixed cost resulting from producing one more unit of output. c. total cost when one more unit of output is produced. d. total fixed cost when one more unit of output is produced.

The Acme Company is a perfect competitor in its input markets and a monopolist in its output market. The marginal product of labor is 20 and the price of Acme's output is $10. For Acme Company, the marginal revenue product of labor is

A) less than $10. B) $10. C) $20. D) less than $200. E) $200

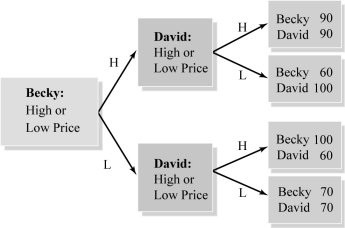

Consider Figure 8.9. If David's payoff in the bottom rectangle were 40 instead of 70, the outcome of the game would be that:

Consider Figure 8.9. If David's payoff in the bottom rectangle were 40 instead of 70, the outcome of the game would be that:

A. both choose a high price. B. both choose a low price. C. Becky chooses a high price and David chooses a low price. D. David chooses a high price and Becky chooses a low price.

The demand for land is upward sloping.

Answer the following statement true (T) or false (F)