Former NFL coach Joe Gibbs is highly sought after as a guest speaker. His fee can run as high as $150,000 for a single two-hour appearance. Recently, he was asked to speak at a seminar offered by the National Sports in Education Foundation (NSEF). Due to the charitable nature of the organization, Mr. Gibbs offered to speak for $100,000. NSEF planned to invite 350 guests who would each make a $500 contribution to the organization. The Foundation's executive director was concerned about committing so much of the organization's cash to this one event. So instead of the $100,000 fee she countered with an offer to pay Mr. Gibbs 50% of the revenue received from the seminar and no other payments.Required:(a) Classify the two offers in terms of cost behavior (fixed vs. variable).Scenario A, NSEF

pays Gibbs a $100,000 fee:Scenario B, NSEF pays Gibbs 50% of revenue:(b) Compute the budgeted income (assuming there are no other expenses) under each of the following scenarios:1) NSEF agrees to pay the $100,000 fee, and 350 guests actually attend the seminar; and2) NSEF pays Mr. Gibbs 50% of revenue, and 350 guests attend the seminar.(c) For each scenario ($100,000 fee vs. 50% of revenue), compute the percentage increase in profit that would result if the Foundation is able to increase attendance by 20 percent over the original plan (to a total of 420). (Round the percentages to the nearest whole numbers.)(d) For each scenario, compute NSEF's cost per contributor if 350 attend and if 420 contributors attend. (Round the cost per contributor to two decimal points.)(e) Summarize the impact on risk and profits of shifting the cost structure from fixed to variable costs.

What will be an ideal response?

(a) Cost behavior of the two offers:

$100,000 fee: Fixed

50% of revenue: Variable

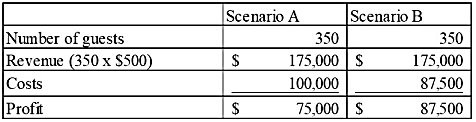

(b) Profit computations:

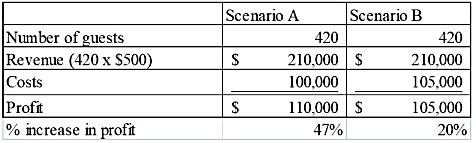

(c) Percentage increase in profit:

($110,000 $75,000) ÷ $75,000 = 47%

($105,000 - $87,500) ÷ $87,500 = 20%

(d) Cost per Guest:

350 attendees

Scenario A, $75,000 ÷ 350 = $214.29

Scenario B, $87,500 ÷ 350 = $250.00

420 attendees

Scenario A, $110,000 ÷ 420 = $261.90

Scenario B, $105,000 ÷ 420 = $250.00

(e) Shifting the cost structure from fixed to variable reduces the level of risk. For example, if no one attends, Mr. Gibbs is paid nothing. However, shifting to variable costs also reduces the potential for profits. For example, a 20 percent increase in attendance results in a 47% increase in profit under the fixed fee scenario but only a 20% increase in profits under the variable cost scenario.

You might also like to view...

According to the theory underlying the present-value formula, would a rational individual prefer to receive (a) $75 one year from now, (b) $85 two years from now, or (c) $90 three years from now, or would he be indifferent between all three choices? Assume that the relevant annual market interest rate is 10 percent and will remain at 10 percent for the next three years?

A. He will prefer $75 one year from now. B. He will prefer $85 two years from now. C. He will prefer $90 three years from now. D. He will be indifferent between all three choices.

According to a recent poll of CEOs, what was mentioned as the number one skill that CEOs are getting coaching for?

A. persuasion skills B. planning skills C. listening skills D. management skills

Only program unit header modifications require a recompilation of dependent objects.

Answer the following statement true (T) or false (F)

Which of the following statements is true?

A. The currency values among different countries rarely fluctuate. B. Cash flows of various parts of a multinational corporate system are always denominated in the same currencies. C. Institutional differences among countries can cause significant problems in coordination of subsidiaries. D. No nation places constraints on the transfer of corporate resources. E. Within similar geographic regions, different countries have uniform cultural heritages that shape values and influence the role of business in the society.