Provide several examples of important taxes on labor in the United States. For a typical worker, what is the marginal tax rate on labor income once all the labor taxes are summed?

*the Social Security tax

*the Medicare tax

*the federal income tax

*a state income tax (for many states)

The marginal tax rate on labor income for a typical worker is about 40 percent.

You might also like to view...

An Oldsmobile dealer may turn to a __________ like GMAC for loans in purchasing vehicles for his inventory

A) investment bank B) broker-dealer C) bootstrap financing company D) captive finance company

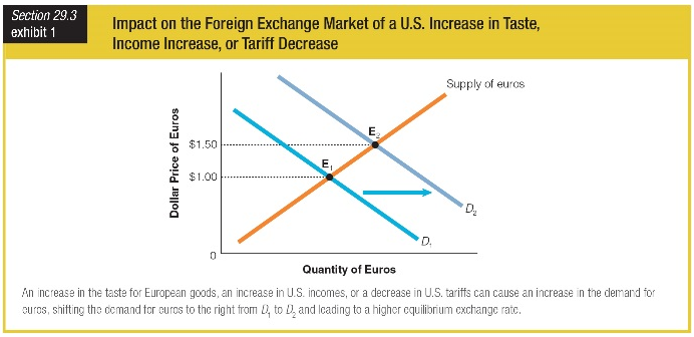

What is the impact on the foreign exchange rate?

a. The euro exchange rate changes from $1.50 per euro to $1.00 per euro.

b. The dollar appreciates in value from $1.00 to $1.50.

c. The euro depreciates in value from $1.50 per euro to $1.00 per euro.

d. The dollar price of euros increases from $1.00 to $1.50.

An international conference in Bretton Woods, New Hampshire, in 1944 resulted in the formation of:

a. the European Union in 1945. b. the Kyoto Agreement in 1971. c. the General Agreement on Tariffs and Trade (GATT) in 1947. d. the International Red Cross in 1955.

The market mechanism:

A.) Works through central planning by the government. B.) Eliminates market failures created by the government. C.) Uses prices as a means of communication between consumers and producers. D.) Is very inefficient since consumers cannot communicate directly with producers.