What is the real (adjusted for inflation) present value of $104.25 that you could receive one year from now, given that the rate of interest is 4.25 percent and the anticipated rate of inflation is 1 percent?

A) $99.05

B) $100.97

C) $107.64

D) $100.00

B

You might also like to view...

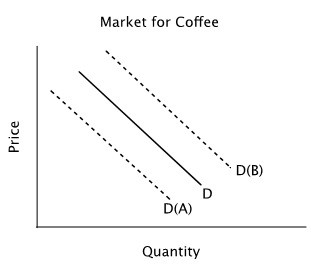

Refer to the figure below. Suppose the solid line shows the current demand curve for coffee. In response to an announcement that much of next year's coffee crop has been destroyed by a storm in Brazil, you should expect:

A. the demand curve to shift to D(A) in anticipation of higher future prices. B. the demand curve to shift to D(B) in anticipation of higher future prices. C. an increase in the quantity of coffee demanded, but no shift in the demand curve. D. neither a change in quantity demanded nor a shift in demand because next year's coffee crop will not affect the current demand for coffee.

In 2007, the interest rate banks in France charge each other for loans was 4.86 percent. The inflation rate in France in 2007 was 2.8 percent. The real interest rate in France is

A) 7.62 percent B) 2.06 percent. C) 0.58 percent. D) 13.6 percent.

Everything else held constant, when output is ________ the natural rate level, wages will begin to ________, increasing short-run aggregate supply

A) above; fall B) above; rise C) below; fall D) below; rise

A consumer who has a limited budget will maximize utility or satisfaction when the:

A. ratios of the marginal utility of each product purchased divided by its price are equal. B. total utility derived from each product purchased is the same. C. marginal utility of each product purchased is the same. D. price of each product purchased is the same.