Explain the differences in how modern and traditional theories of portfolio management approach the issue of diversification

What will be an ideal response?

Answer: The modern approach to portfolio diversification uses computers to analyze a large number of investment alternatives, mathematically seeking minimum correlation and maximum return. Ideally these methods identify portfolios on the efficient frontier with minimum portfolio betas or standard deviations for the expected level of return.

The traditional approach to diversification uses human judgement and experience to choose a diversified combination of stocks and other securities across industry lines and possibly national borders. When done well, this approach also reduces risk without excessively sacrificing return. The traditional approach may lead to overinvestment in the stocks of large, well-known companies because they most readily come to mind for the manager, because the manager fears criticism for omitting them, or wants to avoid blame for less conventional choices (window dressing).

You might also like to view...

In an accrual accounting system,

a. all accounts have normal debit balances. b. a debit entry is recorded on the left-hand side of an account. c. liabilities, owner's capital, and dividends all have normal credit balances. d. revenues are recorded only when cash is received.

Which of the following is not a key question to consider when improving inclusiveness at your workplace?

A) Do invisible barriers prevent people from getting promoted? B) Do all employees feel welcomed at work? C) Does everyone have the chance to contribute fully to the organization? D) Does everyone feel comfortable advancing ideas in meetings? E) Do hiring practices meet the minimum standards in the law?

How do you identify major use cases?

What will be an ideal response?

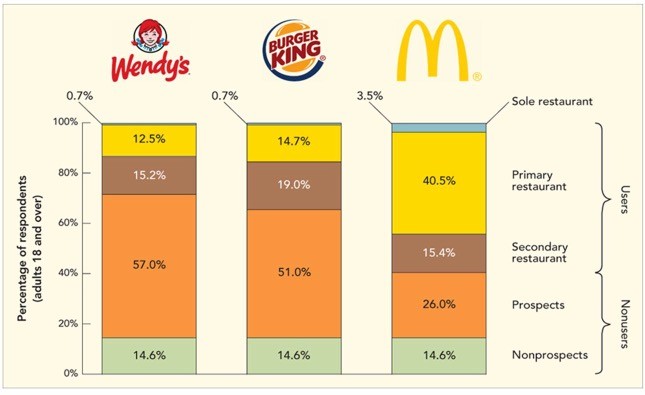

Figure 8-4To the owner of a Wendy's fast food restaurant, the information in Figure 8-4 above suggests that Wendy's prospects are ________ of the total compared to ________ for McDonald's.

Figure 8-4To the owner of a Wendy's fast food restaurant, the information in Figure 8-4 above suggests that Wendy's prospects are ________ of the total compared to ________ for McDonald's.

A. 57.0 percent, 51.0 percent B. 57.0 percent, 26.0 percent C. 15.2 percent, 19.0 percent D. 14.6 percent, 14.6 percent E. 15.2 percent, 40.5 percent