Answer the following statements true (T) or false (F)

1. Although a partner's distributive share of income, deductions, losses, and credits is generally determined by partnership agreement, special allocation provisions restrict the partners' freedom to shift some tax benefits among partners.

2. A partnership sells an asset for a gain. The asset had been transferred to the partnership two years ago by Partner J in exchange for a partnership interest. The asset was worth substantially more than its cost as of the transfer date. The partnership gain will be allocated to all of the partners in accordance with their profit and loss sharing ratios.

3. The basis of a partner's interest in a partnership is adjusted to reflect each partner's share of income and deduction items only if a distribution is made to the partners.

4. A partnership's liabilities have increased by year-end. As a result, partners' bases in their partnership interests will increase.

5. A partner in a partnership will deduct her qualified business income deduction as a deduction for AGI.

1. TRUE

Special allocations must have substantial economic effect.

2. FALSE

The portion of the gain attributable to pre-contribution appreciation will be specially allocated to the contributing partner. The balance of the gain will be allocated in accordance with the profit and loss sharing ratios.

3. FALSE

Basis adjustments for income and deduction items are made currently regardless of whether an actual distribution is made.

4. TRUE

An increase in a partner's share of liabilities is treated as a cash contribution.

5. FALSE

The deduction reduces taxable income. It is deducted after AGI and is deducted regardless of whether the taxpayer takes a standard deduction or itemized deductions.

You might also like to view...

According to your text, in question development, questions should be:

A) understandable, unambiguous, and unbiased B) easy, understandable, long, and appropriate C) appropriate, unbiased, and short D) understandable, attitudinal, loaded and unbiased E) leading but leading not only to desired answers

The Assembly Department of Intuitive, Inc, manufacturer of computers, had 4,500 units of beginning inventory in September, and 3,000 units were transferred to it by the Production Department

The Assembly Department completed 1,500 units during the month and transferred them to the Packaging Department. Calculate the total number of units accounted for by the Assembly Department if it had 6,000 units in ending inventory. The weighted-average method is used. A) 6,000 units B) 3,000 units C) 4,500 units D) 7,500 units

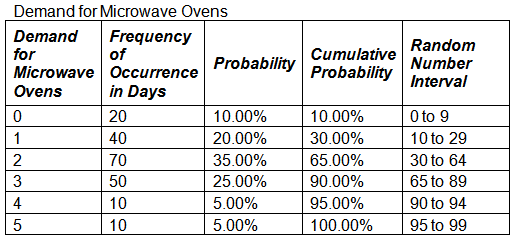

Consider the Demand for Microwave Ovens dataset. What is the total demand corresponding to random numbers 87, 44, 3, 10, 26, and 39?

a. 8

b. 9

c. 10

d. 11

______ ______ ______ is a design principle that recommends segregating classes into separate packages based on primary focus of responsibility

Fill in the blank(s) with correct word