Round the following to the nearest ten, nearest hundred, and nearest thousand.70,255

A.

| Ten | 70,250 |

| Hundred | 70,300 |

| Thousand | 70,270 |

B.

| Ten | 70,260 |

| Hundred | 70,300 |

| Thousand | 70,000 |

C.

| Ten | 70,260 |

| Hundred | 70,250 |

| Thousand | 71,000 |

D.

| Ten | 70,250 |

| Hundred | 70,200 |

| Thousand | 71,000 |

Answer: B

You might also like to view...

Solve the system of equations graphically.Northwest Molded molds plastic handles with a production cost of $0.60 per handle to mold. The fixed cost to run the molding machine is $6372 per week. If the company sells the handles for $3.60 each, how many handles must be molded and sold weekly to break even?

A. 1416 handles B. 1517 handles C. 10,620 handles D. 2124 handles

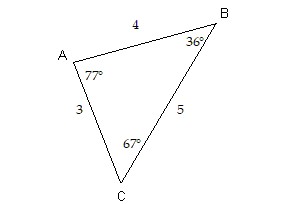

Provide an appropriate response.Suppose ?PQR ? ?ABC, where ?ABC is shown below. Find PQ.

A. 5 B. Cannot be determined C. 3 D. 4

The displacement d (in meters) of an object at time t (in seconds) is given. Describe the motion of the object. What is the maximum displacement from its resting position, the time required for one oscillation, and the frequency?d = 5 sin (5t)

A. simple harmonic; 5 m;  ? sec;

? sec;  oscillations/sec

oscillations/sec

B. simple harmonic; 5 m; 5 ? sec;  oscillations/sec

oscillations/sec

C. simple harmonic; 5 m;  sec;

sec;  ? oscillations/sec

? oscillations/sec

D. simple harmonic; -5 m;  ? sec;

? sec;  oscillations/sec

oscillations/sec

Solve the problem. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and an SDI rate of 1%. Assume the person's earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.Beth Conners worked 43.2 hours last week at Creative Kitchens. She is paid $6.58 per hour, plus  for overtime. Find her Social Security tax and Medicare tax for the week.

for overtime. Find her Social Security tax and Medicare tax for the week.

A. $18.28, $4.27 B. $17.62, $4.12 C. $16.32, $3.82 D. $26.43, $6.18