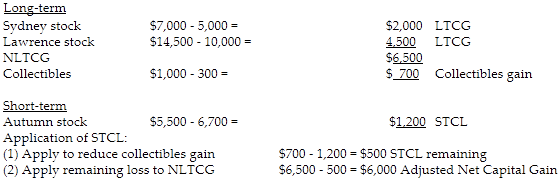

What is the adjusted net capital gain or loss and the related tax due to the above transactions, assuming Chen has a 24% marginal tax rate?

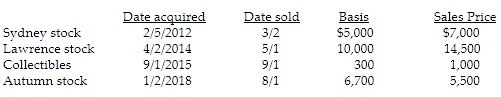

Chen had the following capital asset transactions during 2018:

Tax: $6,000 ANCG × .15 = $900

You might also like to view...

The Core Principles of Professional Selling require people whose personal character is at level 2.

Answer the following statement true (T) or false (F)

A company has beginning inventory of 15 units at a cost of $12 each on October 1. On October 5, it purchases 10 units at $13 per unit. On October 12 it purchases 20 units at $14 per unit. On October 15, it sells 30 units. Using the FIFO periodic inventory method, what is the value of the inventory at October 15 after the sale?

A. $590 B. $210 C. $160 D. $380 E. $140

Only those consequential damages that are known or foreseeable can be collected

Indicate whether the statement is true or false

Wellesley, Inc uses the indirect method to prepare the statement of cash flows

Refer to the following section of the comparative balance sheet: Wellesley, Inc Comparative Balance Sheet December 31, 2017 and 2016 2017 2016 Increase/(Decrease) Cash $42,000 $25,000 $17,000 Accounts Receivable 32,000 55,000 (23,000 ) Merchandise Inventory 180,000 123,000 57,000 Total Assets $254,000 $203,000 $51,000 The change in Merchandise Inventory is shown as a negative cash flow in the adjustments to net income. Indicate whether the statement is true or false