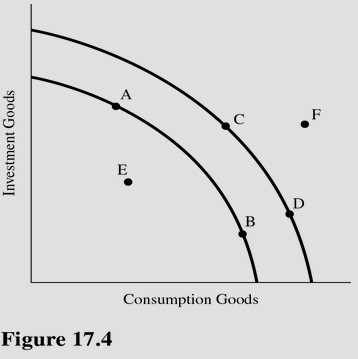

Tax incentives that encourage businesses to purchase more capital goods could result in a long run movement in Figure 17.4 from point

Tax incentives that encourage businesses to purchase more capital goods could result in a long run movement in Figure 17.4 from point

A. B to point C.

B. C to point D.

C. A to point C.

D. E to point B.

Answer: A

You might also like to view...

Nick considers macaroni and cheese to be an inferior good. As a result of macaroni and cheese being an inferior good, the

A) substitution effect must be larger in magnitude than the income effect so that less is purchased as the price falls. B) substitution effect must be smaller in magnitude than the income effect so that less is purchased as the price falls. C) income effect is positive, so that more is purchased as income increases. D) income effect is negative, so that less is purchased as income increases.

The origins of modern monetarism lie in the work of the

A) Classical economists. B) Keynesians. C) Malthusians. D) Mercantilists.

The demand curve for loanable funds slopes down because

A) at lower bond prices more loanable funds will be supplied. B) lower interest rates reduce the inflation rate. C) an increase in the interest rate makes borrowers more willing and able to demand more funds. D) a decrease in the interest rate makes borrowers more willing and able to demand more funds.

Instruments so widely accepted and purchased by others that they are very similar to cash are known as

a. liquid assets b. hard assets c. corporate assets d. marketable securities e. none of the above