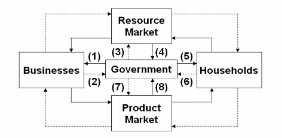

Refer to the diagram, in which solid arrows reflect real flows; broken arrows are monetary flows. Flow (6) might represent:

A. the payment of payroll taxes by households.

B. corporate income tax payments.

C. the purchase of basketballs by the Ogallala school district.

D. the purchase of armored personnel vehicles by government.

A. the payment of payroll taxes by households.

You might also like to view...

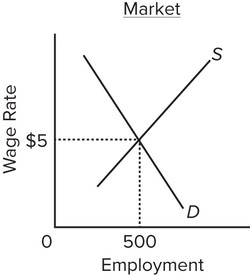

Use the following diagram to answer the next question. Which of the following statements about this market is not correct?

Which of the following statements about this market is not correct?

A. A wage rate of $5 maximizes the number of workers employed. B. Employers would benefit from a higher wage since they could profitably attract more workers. C. At a wage rate greater than $5 less than 500 workers would be employed. D. At a wage rate less than $5, less than 500 workers are supplied, so no more can be employed.

Why is the following statement incorrect: "A tax on all consumption goods is efficient because it equally taxes all goods and therefore does not distort their prices."

What will be an ideal response?

You make a loan to the government of $100. The government promises to pay you back some sum of money in two years. The interest rate will be 4 percent over that period, but inflation will be 4 percent. How much will you require that the government pay you in two years in the absence of any inflation? With inflation?

What will be an ideal response?

The longer any price change lasts over time, the

A) more difficult it is to alter quantity demanded. B) the more quickly quantity demanded will return to its original level. C) the longer the short-run equilibrium will continue to be the short-run equilibrium. D) more quantity demanded will change.