The statutory incidence of the tax means who:

A. is legally obligated to pay the tax to the government.

B. actually loses surplus as a result of the tax.

C. bears the burden of any sort of tax.

D. gains surplus as a result of the government redistributing tax revenue.

A. is legally obligated to pay the tax to the government.

You might also like to view...

In the simple circular flow model containing just households and business firms, the entire product flows to ________ in exchange for ________

A) business firms, labor services B) business firms, wages C) households, consumer expenditures D) households, labor services

Between 1929 and 2009, the U.S. economy grew at an average annual rate of ________

a. 10.4 percent b. 7.9 percent c. 5.2 percent d. 3.3 percent

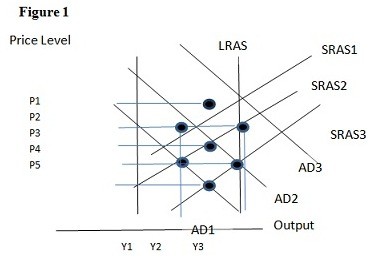

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the short run would be:

A. P3 and Y1. B. P2 and Y1. C. P2 and Y3. D. P1 and Y2.

One result of adverse selection in the market for used cars is:

A. more lemons (low quality) may be offered for sale than plums (high quality). B. more plums (high quality) may be offered for sale than lemons (low quality). C. few lemons (low quality) are sold. D. no used cars are sold.