A risk-averse investor compared to a risk-neutral investor would:

A. require a higher risk premium for the same investment as a risk-neutral investor.

B. place less focus on expected return than the risk-neutral investor.

C. place more focus on expected return and less on return than the risk-neutral investor.

D. offer the same price for an investment as the risk-neutral investor.

Answer: A

You might also like to view...

An association of producers such as OPEC that agrees to set common pricing or output goals is referred to as a

A) cartel. B) conglomerate. C) monopoly. D) partnership.

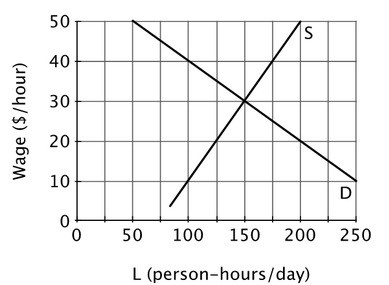

Assume that this graph illustrates a perfectly competitive labor market. Suppose a minimum wage law required the wage to be at least $20 per hour in this market. If that happened, then:

Suppose a minimum wage law required the wage to be at least $20 per hour in this market. If that happened, then:

A. there would be excess demand for person-hours. B. there would be an excess supply of person-hours. C. there would be no change in the equilibrium number of person-hours. D. the demand for person-hours would shift to the right.

Using the aggregate demand/aggregate supply model, explain the difference in the employment prospects of the graduates of 2007 and 2009.

What will be an ideal response?

Related to the Economics in Practice on page 239: All else equal, more highly educated people are ________ than those who have less education.

A. more likely to hold stock B. less likely to hold stock C. always going to earn more from investing in stock D. no more or no less likely to hold stock