The vicious-circle-of-poverty hypothesis states that poor countries

A. cannot develop because their economic policies are ineffective.

B. cannot develop because people don't consume due to lack of goods and services.

C. are unable to save and invest enough to accumulate capital stock that would help them grow.

D. cannot develop because they lack the ability to educate their workers.

Answer: C

You might also like to view...

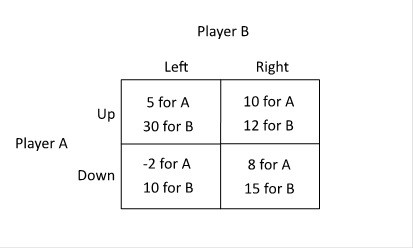

Refer to the figure below. Player B can infer that Player A will:

A. choose Down when B chooses Left and choose Up when B chooses Right. B. always choose Up. C. always choose Down. D. choose Up when B chooses Left and choose Down when B chooses Right.

The U.S. experience with tax cuts and tax increases since 1975 suggests that

a. tax cuts always stimulate consumption spending. b. tax changes have a stable and predictable effect on consumption spending. c. temporary tax changes are less effective than permanent changes. d. tax changes have no effect on consumption spending.

Under a regressive tax, the fraction of income paid in taxes

A. rises as income rises. B. is unchanged as income changes. C. falls as income rises. D. is proportional to the change in income.

An externality occurs whenever

A) private costs are the same as social costs. B) private costs are the same as internal costs. C) private costs diverge from social costs. D) private costs plus internal costs equal social costs.