A tariff is

A) a limit placed on the quantity of goods that can be imported into a country.

B) a tax imposed by a government on goods imported into a country.

C) a subsidy granted to importers of a vital input.

D) a health and safety restriction imposed on an imported product.

Answer: B

You might also like to view...

Explain the differences between positive economic analysis and normative economic analysis. Which of these approaches do economists generally adhere to and why?

What will be an ideal response?

If the legislature has a line-item veto on a bureau's budget, the bureau

a. can no longer present its entire budget as a package deal for provision of services b. will have more power than if the legislature used an overall budget ceiling c. will be able to supply its output to the legislature as a monopolist d. will try to discourage budget cuts by threatening to make cuts that will cause the legislature the least political trouble e. will be free to pursue its own overall objectives

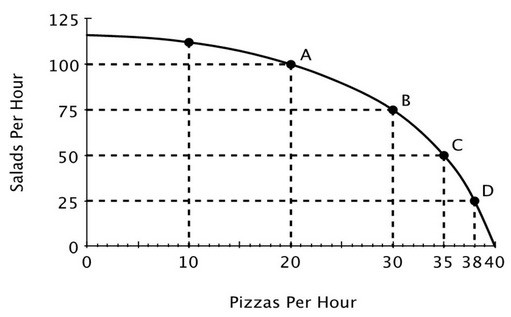

Refer to the accompanying figure. Moving from point B to point A, the opportunity cost of 25 more salads is:

A. 15 pizzas. B. 20 pizzas. C. 5 pizzas. D. 10 pizzas.

Potatoes cost Janice $0.50 per pound, and she has $6.00 that she could possibly spend on potatoes or other items. Suppose she feels that the first pound of potatoes is worth $1.50, the second pound is worth $1.14, the third pound is worth $1.05, and all subsequent pounds are worth $0.30.

a. How many pounds of potatoes will she purchase?

b. What if she only had $3.00 to spend?