Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.Drew Laughlin, attorney, earned $64,967.84

A. $4028.01, $1884.07

B. $7956.01, $1784.07

C. $8056.01, $1884.07

D. $4028.01, $942.03

Answer: C

You might also like to view...

Perform the indicated operation. Simplify if possible. +

+

A. x - 3 B. x - 6 C. x + 3 D. x + 6

Solve the problem.A plane flies 420 miles with the wind and 300 miles against the wind in the same length of time. If the speed of the wind is 25 mph, what is the speed of the plane in still air?

A. 140 mph B. 150 mph C. 155 mph D. 175 mph

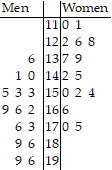

Construct the indicated stemplot.The following data consists of the weights (in pounds) of 15 randomly selected women and the weights of 15 randomly selected men. Construct a back-to-back stemplot for the data.Women:  Men:

Men:

A.

? ? |

B.

? ? |

Solve the problem.Tickets for a play are sold at two prices; $16, and $29. Find a formula for the total cost T (in dollars) of k tickets that sold for $16 per ticket and n tickets that sold for $29 per ticket. Use the formula to find the value of T when k = 88 and n = 77.

A. T = $3784 B. T = $3741 C. T = $3641 D. T = $364,100